- HOME

-

PRODUCTS

PRODUCTS

-

LR03/AAA/E92/AM4

1.5V Plus Alkaline Battery

→ -

LR6/AA/E91/AM3

1.5V Plus Alkaline Battery

→ -

6LR61/9V/6LF22

1.5V Plus Alkaline Battery

→

-

R03P/UM-4/AAA SIZE

Super Heavy Duty AAA

→ -

R6P/UM-3/AA SIZE

Super Heavy Duty AA

→ -

6F22/9V Zinc-Carbon Battery

Metal Jacket

→

-

Silver Oxide Button Battery

1.55V Button Cell Battery

→ -

Li-MnO2 Button Cell Battery

3V Lithium Manganese Button Cell

→ -

Zinc Air Button Cell Battery

Hearing Aid Batteries

→

-

NI-MH AAA 550-1100mah

CONSUMER USE

→ -

NI-MH AA 600-2700mAh

CONSUMER USE

→ -

NI-MH AAAA 200-550mAh

INDUSTRY USE

→

-

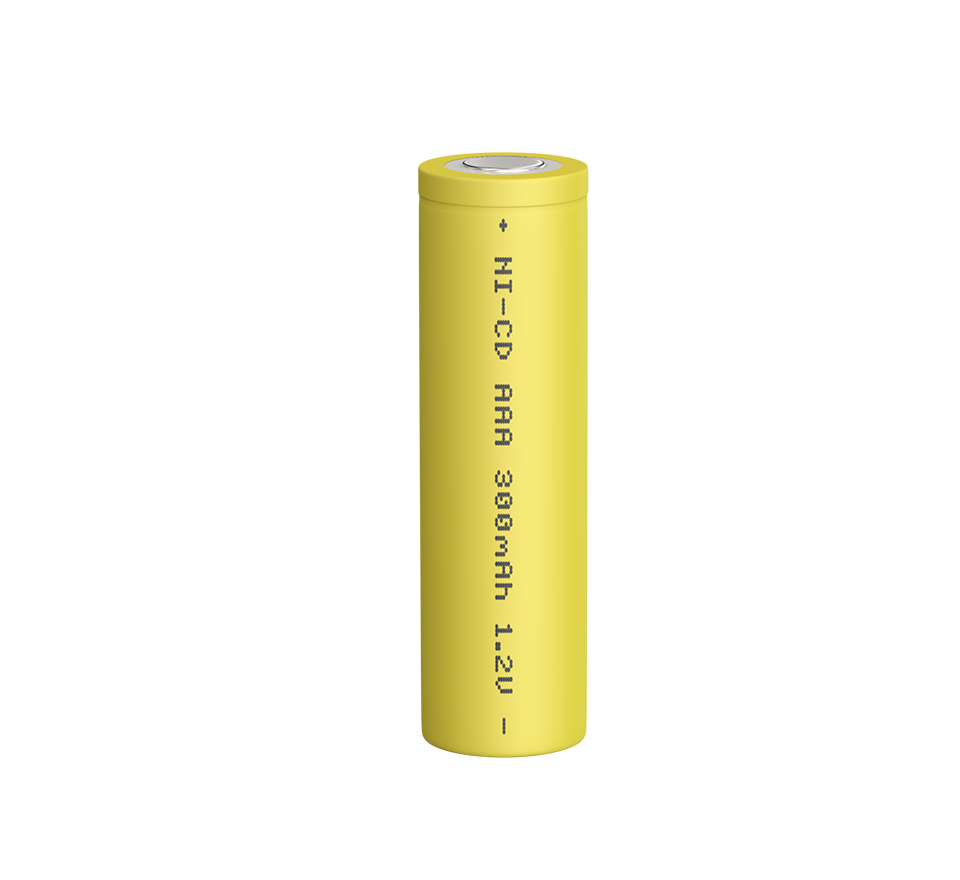

Ni-CD AAA 60-350mAh

INDUSTRY USE

→ -

Ni-CD AA 150-1100mAh

INDUSTRY USE

→ -

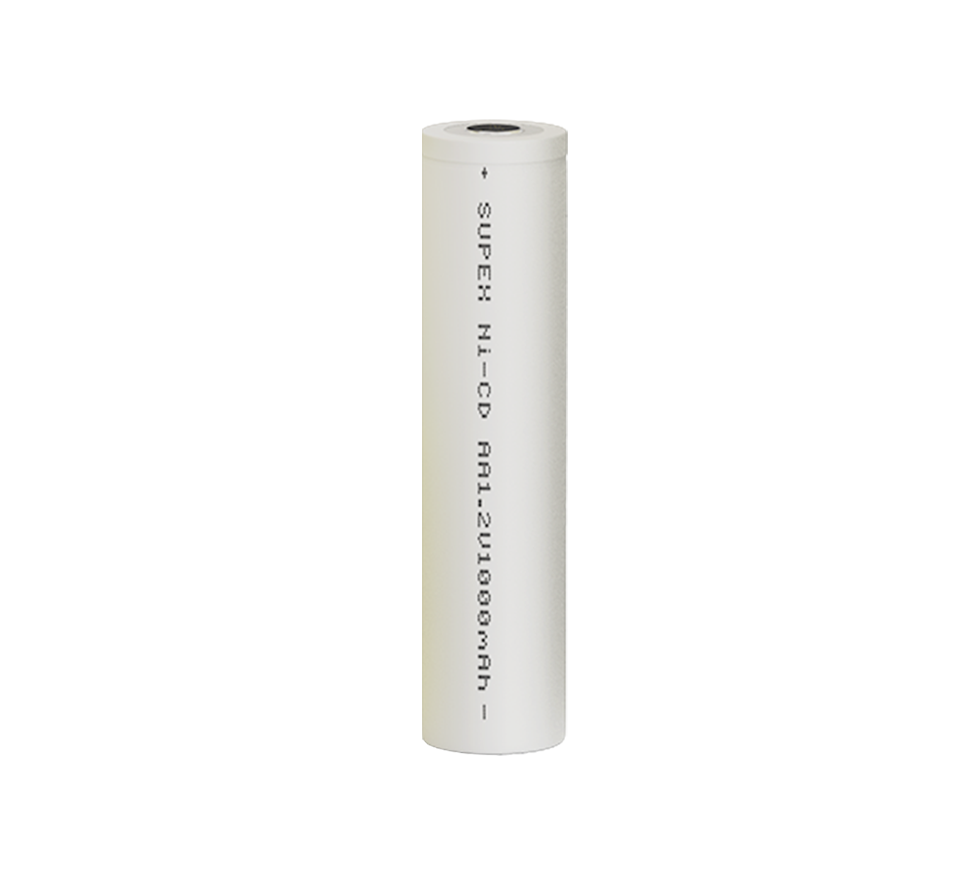

Ni-CD A 240-1600mAh

INDUSTRY USE

→

-

ICR14500 Rechargeable Cell

ICR(LiCoO₂)3.7V Lithium-ion Batteries

→ -

ICR18650 Rechargeable Cell

ICR(LiCoO₂)3.7V Lithium-ion Batteries

→ -

INR18650 Rechargeable Cell

INR(NCM/NCA)3.7V Lithium-ion Batteries

→

-

- CASES

- CONTACT US

- Alibaba

- Made-in-China

- QUOTE